Technology is reshaping almost every industry, and the insurance sector is no exception. In the past, getting an insurance quote was a complex process that could take days or even weeks. Today, thanks to digital tools, individuals and businesses can get instant, tailored quotes from the comfort of their own homes. These tools not only provide convenience but also enable users to quickly compare multiple options, ensuring they get the best coverage for their unique needs. For residents and businesses working with an insurance agency Grayslake IL customers trust the process becomes even more streamlined and efficient.

The shift to digital solutions has not just benefited consumers; it’s also improved internal efficiency for insurance providers, minimized paperwork, and sharply reduced response times. No matter your specific needs, access to fast, reliable information is now at your fingertips, reflecting a broader trend of digital transformation in financial services.

The Rise of Digital Quoting Platforms

For years, obtaining insurance meant scheduling appointments or making numerous phone calls to different insurers. Now, digital quoting platforms have disrupted this outdated approach. Users can quickly enter their information online and receive competitive quotes in just minutes. These platforms analyze user data to match consumers with bespoke policy options that address their personal or business requirements.

Companies like Insurify, Policygenius, and others have set industry standards by aggregating quotes from multiple insurers, allowing consumers to make side-by-side comparisons and choose the coverage that offers the best value. This level of transparency and efficiency isn’t just a convenience; it’s dramatically impacting how people shop for and think about insurance.

Artificial Intelligence Enhancing Accuracy

Artificial Intelligence is at the heart of the next leap in insurance quoting innovation. AI algorithms can analyze massive datasets, everything from demographic information to recent claims histories and market trends, to offer quotes that are not only more accurate but also more tailored to individual customers.

With AI, insurers can predict risk with greater precision. This not only shortens customer turnaround time but also reduces the likelihood of human error. The result is an improved customer experience and policies that better fit each client’s actual risk profile, reflecting AI’s growing influence across financial and insurance technology.

Transparent Comparisons Empower Consumers

One of the primary advantages of digital insurance tools is the ability to make transparent comparisons among a wide variety of products and providers. Traditional insurance processes often obscured fee structures, policy terms, or deductible specifics, leaving consumers frustrated or uncertain about their choices.

Today, digital quoting platforms explicitly outline each policy’s features, benefits, and costs. Timely access to this information empowers shoppers, helping them avoid hidden fees, unnecessary coverages, or mismatched policies. This transparency also enhances trust, making it easier to select policies that align with both needs and budgets.

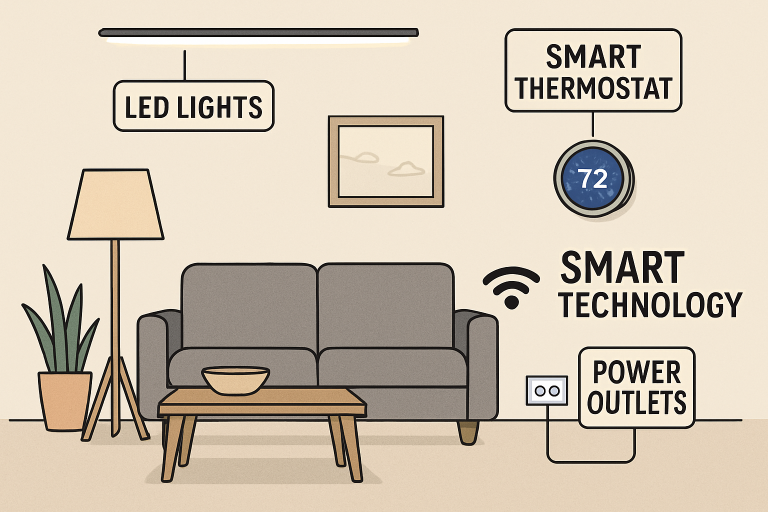

Mobile Applications for On-the-Go Access

Mobile applications have become indispensable in modern insurance services. Almost all major insurance providers now offer mobile apps that let users generate quotes, review documentation, update policy details, and even file claims directly from their smartphones.

These apps ensure customers have constant and immediate access to information, no matter where they are. Features like photo uploads for claims, live chat support, and real-time document sharing add further convenience. A Wall Street Journal study describes how mobile innovation is transforming the customer experience across industries.

Data Security in the Digital Age

As convenience and speed increase, so does the responsibility to protect sensitive consumer information. Insurance companies use advanced encryption, secure authentication, and ongoing monitoring to safeguard personal and financial data against cyber threats.

Regulatory compliance, such as maintaining GDPR or HIPAA standards, remains a priority. For customers, this focus on security builds confidence in using digital channels for managing their insurance needs.

Real-Life Example: Small Business Insurance

Small business owners have seen significant benefits from digital transformation in insurance. Digital platforms now allow small enterprises to quickly obtain tailored quotes for workers’ compensation, property, or liability insurance. According to an Insurance Journal article, leading carriers continually expand their digital quoting and binding capabilities to support small businesses’ needs in real time, keeping pace with today’s fast-moving entrepreneurial landscape.

Conclusion

The digital revolution has fundamentally changed the way individuals and businesses navigate the insurance market. From instant online quotes and AI-powered policies to transparent platforms and secure mobile applications, digital tools make the process faster, easier, and more reliable than ever before. Customers are better informed and more empowered, ensuring they find the right coverage to safeguard their futures.

YOU MAY ALSO LIKE: Safeguarding Your Property: The Importance of Openhouseperth.net Insurance